To help you to monitor your competition, HINGE Axis automatically pulls third-party seller reports for your entire product catalog on Amazon. This data is updated every week.

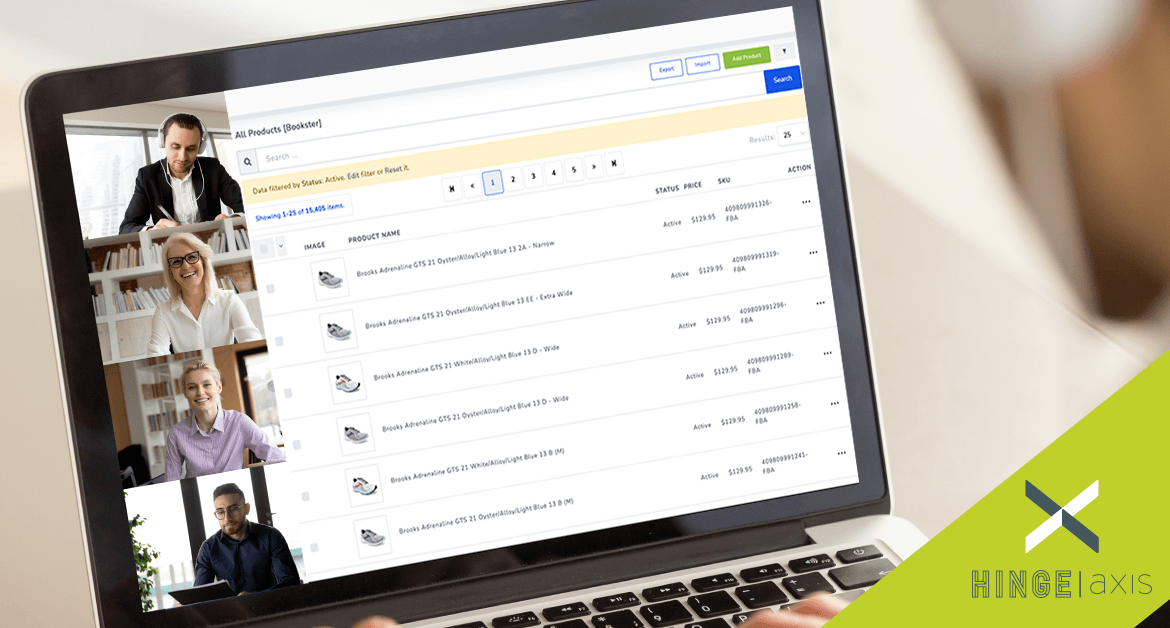

The ground-breaking Amazon seller software, Hinge Axis, has been selected by Amazon to be included in the Amazon Seller Central Partner Network. Hinge Axis is a cutting-edge SaaS (software as a service) platform to manage and grow Amazon and other eCommerce businesses.

The HINGE Axis Product Hub makes it easy to manage your complex Amazon product catalog manually or with ad hoc systems.

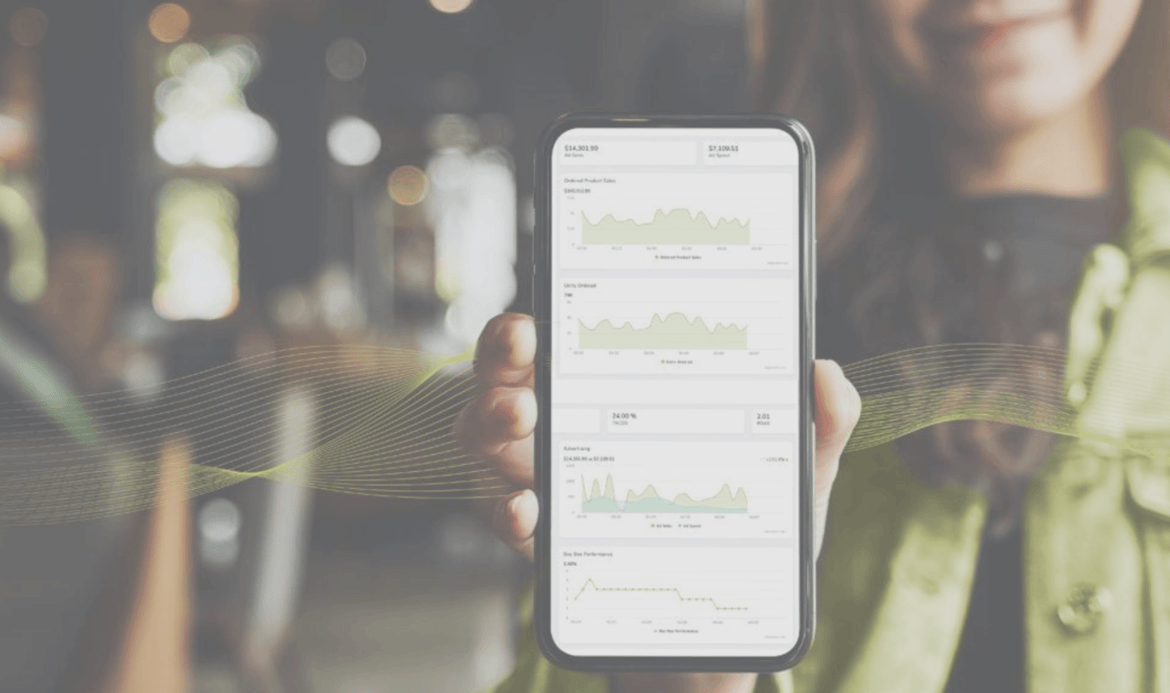

The Hinge Axis Dashboard enables Amazon Sellers to manage every aspect of your Amazon business from a single software. Keep your finger on the pulse of your business using our real-time, easy-to-read dashboard, integrating data from over 200 separate Amazon reports.

HINGE Axis is a breakthrough new eCommerce software that gives you the tools you need to efficiently run your Amazon business from a single command center.

HINGE COMMERCE, an industry-leading eCommerce agency, has launched a ground-breaking eCommerce software service called HINGE Axis. HINGE Axis is a proprietary Amazon seller platform that simplifies and streamlines the management of Amazon and helps sellers save time and grow their sales profitability.

As a certified Amazon agency, HINGE COMMERCE can provide the full range of Amazon DSP inventory, in addition to Amazon’s standard ad platforms. With these tools, we can help you maximize your brand reach, and drive awareness and consideration.

If you are like most people, thinking about tax paperwork may fill you with dread. For online sellers on marketplaces like Amazon, Walmart.com, and even your own e-commerce sites, calculating and filing sales tax can be overwhelming.

This article provides some basic tips to help you start to tackle your sales taxes for your digital commerce business.

Determine where you have a sales tax nexus. This is a function of your physical business locations, personnel locations, and inventory warehouse locations.

Determine where you have economic nexus. Even if you do not have a physical presence in a state, if you pass the economic threshold for total revenue or transactions in a state, you are legally required to collect and remit sales tax to that…